CLIENT NOTICES | For the latest client updates, including new Florida E-Verify obligations and client ERC claim information, please visit www.spli.com/clientnotices

How Personal Account Executives Simplify Payroll for Small Businesses

March 18, 2025

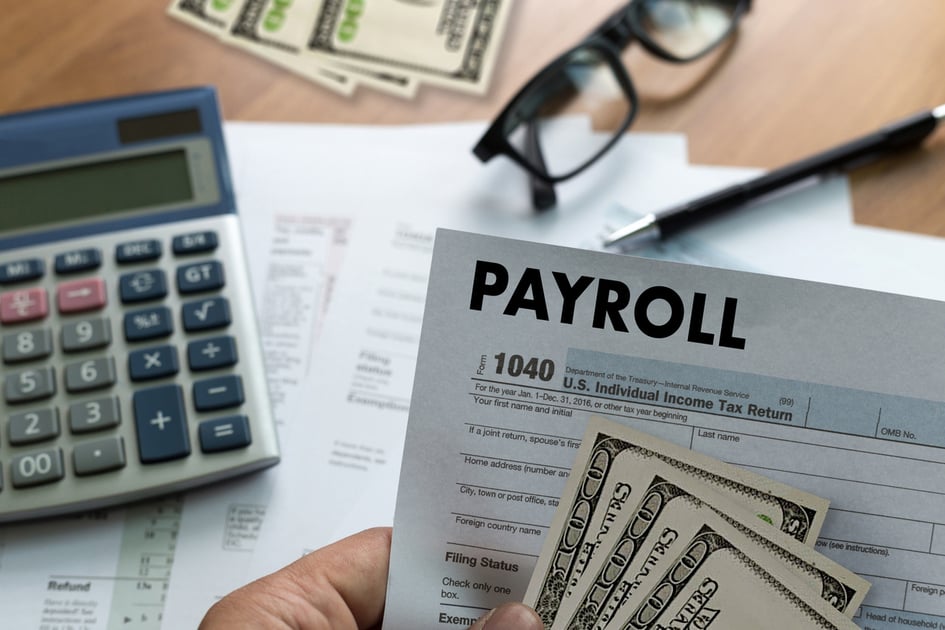

As a small business owner, you’re already juggling countless responsibilities. When payroll issues arise, the last thing you need is to navigate frustrating phone trees or explain your situation to yet another customer service representative who knows nothing about your business.

In today’s modern business world, most payroll solutions promise convenience through automation but deliver headaches when you need personalized support. The result? You waste valuable time that could be spent growing your business.

What if your payroll service combined modern efficiency with dedicated human support? Let’s explore why personal account executives make all the difference when managing payroll for small businesses.

The Real Cost of Automated Payroll Systems

The rise of digital payroll platforms has streamlined certain aspects of workforce management. However, this convenience often comes with a significant amount of hidden costs:

Impersonal Support Systems

We’ve all been there–pressing “0” repeatedly, hoping to bypass an automated system to reach an actual human. When payroll questions come up (and they inevitably do), many services route you through labyrinthine phone trees or limit you to generic online FAQs.

One-Size-Fits-All Solutions

Digital platforms typically offer standardized packages designed for the average business. But your company isn’t average–It has unique needs, workflows, and industry-specific challenges that templated solutions often cannot address.

Limited Strategic Guidance

Automated systems can process numbers, but they can’t provide context-specific advice about how payroll decisions impact your broader business strategy, tax planning, or compliance requirements.

New Business Uncertainty

For first-time business owners or those setting up payroll for a growing team, simply typing things into a form leaves plenty of room for costly errors. How can you be confident you’re making optimal choices without expert guidance?

Compare Your Options:

|

Automated Payroll Systems |

|

|

Generic customer service representatives |

Dedicated contact person |

|

Standard template solutions |

Customized approach to your business |

|

Reactive problem-solving |

Proactive issue prevention |

|

Self-service troubleshooting |

Guided expert assistance |

|

Generic knowledge base |

Industry-specific Expertise |

How Personal Account Executives Transform Small Business Payroll

At SPLI, we take a fundamentally different approach to payroll for small businesses. As a Professional Employer Organization (PEO), we combine modern technology with personalized service. While we embrace technology to enhance efficiency, we believe that small businesses deserve personalized services from knowledgeable professionals who understand their unique challenges.

Industry-Specific Expertise When You Need It

Your dedicated account executive becomes familiar with your business operations, industry requirements, and specific needs. This relationship means that you’re not starting from zero with each interaction. Your executive already understands the context of your situation and can provide tailored advice.

For example, construction companies often deal with complex worker classifications and multi-state compliance issues. Your SPLI account executive will have specialized knowledge of these industry-specific challenges, helping you navigate them with confidence.

Integrated Payroll and Workers’ Comp Management

One of the most challenging aspects of business administration is managing the intersection of payroll and workers’ compensation. With separate systems, reconciliation becomes another task on your already full plate.

Our dedicated account executives work with you to simplify and coordinate payroll and workers’ comp management. Through personalized support and an integrated approach, they can help reduce complexity and make day-to-day administration more efficient.

With the help of your account executive and our integrated workers’ comp solutions, you can reduce administrative burden while helping prevent costly errors.

Proactive Problem Prevention

Unlike reactive support systems that address issues only after they’ve become problems, your account executive can identify potential challenges before they impact your business.

This proactive approach includes:

- Suggesting process improvements based on your specific workflow

- Keeping you informed about regulatory challenges affecting your industry

Communication on Your Terms

Sometimes, you want to send a quick email. Other times, a phone conversation is more efficient. Your personal account executive adapts to your preferred communication style rather than forcing you into a one-size-fits-all support system.

Measurable Business Benefits Beyond Basic Processing

The value of personalized payroll services extends far beyond basic administration functions. Here’s the tangible impact it has on your business operations:

Significant Time Savings

The average small business owner spends 5-10 hours per month on payroll-related tasks. With personalized payroll support, many clients report cutting this time in half.

A PayrollOrg study found that 57% of small business leaders who outsourced payroll were able to dedicate more time to their primary business functions.

Strategic Business Decision Support

When considering business changes, like hiring contractors, expanding to new states, or adjusting compensation structures, your account executive provides insights about how these decisions will impact your payroll and workers’ comp requirements before you make potentially costly mistakes.

Peace of Mind

Perhaps most valuable is the confidence that comes from working with a dedicated professional who’s responsible for this critical business function.

What’s Included in SPLI’s Personalized Payroll Services

When evaluating payroll solutions for your small business, understanding the full value of what you’re getting is required. With SPLI’s personalized approach, your investment in our PEO services includes:

- Comprehensive Payroll Processing: Complete management of payroll calculations, tax withholdings, direct deposits, and reporting

- Tax Administration: Handling of payroll tax filings, payments, and year-end tax documents including W-2s

- Workers' Compensation Integration: Seamless coordination between payroll and workers’ comp for accurate premium calculations

- Regulatory Compliance: Staying current with changing federal, state, and local employment laws

- Employee Self-Service Portal: Secure access for employees to view pay stubs, tax documents, and personal information

- Dedicated Account Executive: A single point of contact who understands your business needs

The value of these combined services often exceeds what businesses would pay for separate, disconnected solutions. Most importantly, the personalized guidance from your account executive ensures you’re maximizing the benefits of your specific business situation.

How Our Personalized Payroll Services Work

When you partner with SPLI for your payroll services, you’ll experience a smooth, structured onboarding process:

- Initial Consultation: We begin by understanding your business model, workforce structure, and specific challenges rather than pushing you into a predetermined package.

- Personalized Setup: Your executive helps configure your payroll systems to align with your business processes rather than forcing you to adapt to rigid software requirements.

- Data Migration: We handle the transfer of your employee information and other essential data with minimal disruption to your operations.

- Team Training: Your account executive will coordinate with our onboarding team and provide training for you and your team on accessing and using the system.

- Ongoing Partnership: Regular check-ins ensure your payroll solution continues to meet your needs as your business evolves.

Our personalized payroll services include comprehensive payroll processing, tax filings and compliance, dedicated account executive support, workers’ compensation integration, and ongoing consultations that allow your payroll solutions to grow with your business.

Visit our About Us page to learn more about our commitment to personalized services.

Is SLPI’s Personalized Approach Right for Your Business?

While many businesses can benefit from personalized payroll services, this approach is particularly valuable for:

- Businesses in industries with complex classification or compliance requirements

- Companies with seasonal or variable workforce needs

- Growing businesses experiencing frequent operational changes

- Enterprises operating in multiple jurisdictions with varying regulations

- Organizations that value relationship-based business partnerships

Our approach benefits industries such as construction, commercial trucking and transportation, landscaping services, manufacturing, maritime, cell tower, and other professional services. Learn more about our industry-specific solutions.

Experience the SPLI Difference

At SPLI, we believe small businesses deserve both efficient technology and personal service. Our approach combines modern payroll systems with dedicated account executives who know your business

This balanced approach means you get the best of both worlds: the convenience of digital tools with the assurance that a knowledgeable professional is overseeing your payroll processes and is available when you need guidance.

Ready to experience the human touch in PEO? Contact us today to schedule a free consultation and learn how our personal account executives can simplify payroll management for your small business.

LEGAL DISCLAIMER:

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user, or browser; we do not recommend or endorse the contents of the third-party sites.

Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of and access to this website or any of the links or resources contained within the site do not create an attorney-client relationship between the reader, user, or browser and website authors, contributors, contributing law firms, or committee members and their respective employers.